It seems like most Americans are struggling these days. While economic systems influence this greatly, they are also discussed ad nauseam. More importantly, it's very difficult for an individual to influence those systems, and the broader economic state. However, we all have the ability to immediately and directly influence our own biases and perspectives. And in that regard, I think it's interesting to consider some of the many problems that stem from Western culture, particularly in the United States.

Through television, music, movies and social media we are peddled an illusion of wealth. We are programmed from a fairly young age to have unrealistic expectations about what an average lifestyle should be able to afford. Additionally, many Americans have limited experience traveling abroad, which can insulate our views and make it difficult to compare our lifestyles with those of people in a wider range of socioeconomic areas. This subtle and persistent influence drives many Americans to overspend. Debt and general consumerism are viewed not only as normal, but as a matter-of-fact part of life. In the following article, I'll attempt to dismantle some of the apparent issues.

Dream colleges are financial nightmares

It goes without saying that the higher education system in our country is riddled with systemic flaws. Student loan programs might be a necessary evil, but they are crippled by perverse incentives and predatory organizations. That said, the responsibility for our collective $1.8T in student loan debt cannot be pinned entirely on these actors. Culturally, many are driven to expensive schools by elitism and sport fanaticism. In fact, this phenomenon has been given a name; the Flutie effect, named after legendary quarterback Doug Flutie.

Rather than obtain an education from local community colleges, many students take on expensive loans to attend their college of choice. Some might be driven by sports fanaticism, while others choose esteemed universities based on their reputation for intellectual elitism. Roughly a quarter of students will move to different states in the pursuit of their dream schools. The additional tuition from out-of-school rates results in an average student loan debt of $180,000, plus interest over the loan period. Needless to say, that number can be crippling. Even an in-state tuition from a popular college can come with a price tag of over $50,000 in principal debt. It's no wonder why the average student borrower takes 20 years to pay off their student loans!

Much of the incentive to do this is perpetuated by movies and media, which have continually pushed the narrative of attending elite universities. Students have been promised everything from vibrant social lives to higher job prospects. However, there is only minimal evidence to suggest that prestigious university graduates command higher salaries. And I was unable to find any evidence suggesting differences in post-graduation employment rates. My intuition is that degree selection and individual aptitude plays a much larger role in either of these factors, and that many students are taking on crippling debt in pursuit of a false narrative.

Finances take the passenger seat

In my opinion, this is one of the more glaring problems in United States culture. For many living in the United States, public transportation is not a feasible option. And even for those living in places with access to public transportation, our culture still incentivizes and encourages us to drive ourselves.

For many, our senses of identity and ego are also tied directly to the car we drive. Men in particular have been subconsciously influenced from a young age to associate our cars with our sense of identity and wealth. We're told that sports cars make us cool, and that big trucks make us manly. Pop culture directly tied automobiles to our movies, literature and even our music. Many Americans use gasoline prices as their core index of our country's economic state. From this pervasive psychological conditioning, Americans have been driven to spend an average of $532 per month on used car loans, and $748 per month on new car loans. This fuels over $1.65 trillion in auto loan debt, and it's estimated that the average American throws away $7,000 on their auto loan interest alone. It's worth pointing out that these alarming numbers don't even begin to factor in other related costs such as insurance, gasoline and maintenance.

Housing looms over our heads

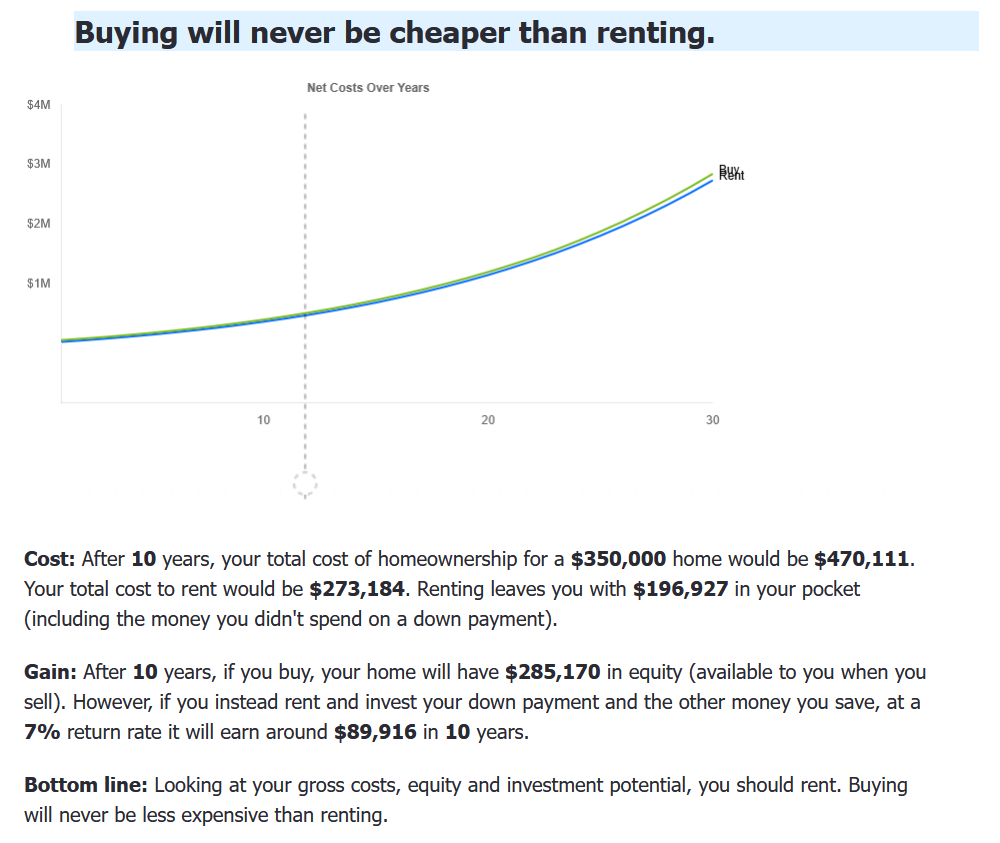

Another of the glaring cultural issues in America is the idealized view on home ownership. Many people view property ownership as the holy grail of adult life, signaling that you've graduated above the line of poverty and "made it." Furthermore, social media pushes the narrative that this is one of the most influential and successful ways to build your wealth. Reality is far from these common misconceptions, and the finances of home ownership is very murky.

Dismantling this topic could easily consume an entire article of its own, and instead I'll encourage readers to watch Ben Felix's video on the subject. In short, the finances of home ownership isn't as straightforward as the popular narrative might lead you to believe. Investing in real estate entails many forms of risk, from burst pipes to declining neighborhoods. It also locks your money into a much less flexible asset, which can't be easily or partially liquidated. Many (perhaps even most) Americans would be financially better off by renting and investing in the general stock market, which historically outperforms the housing market by a very sizeable margin.

Eating through our budgets

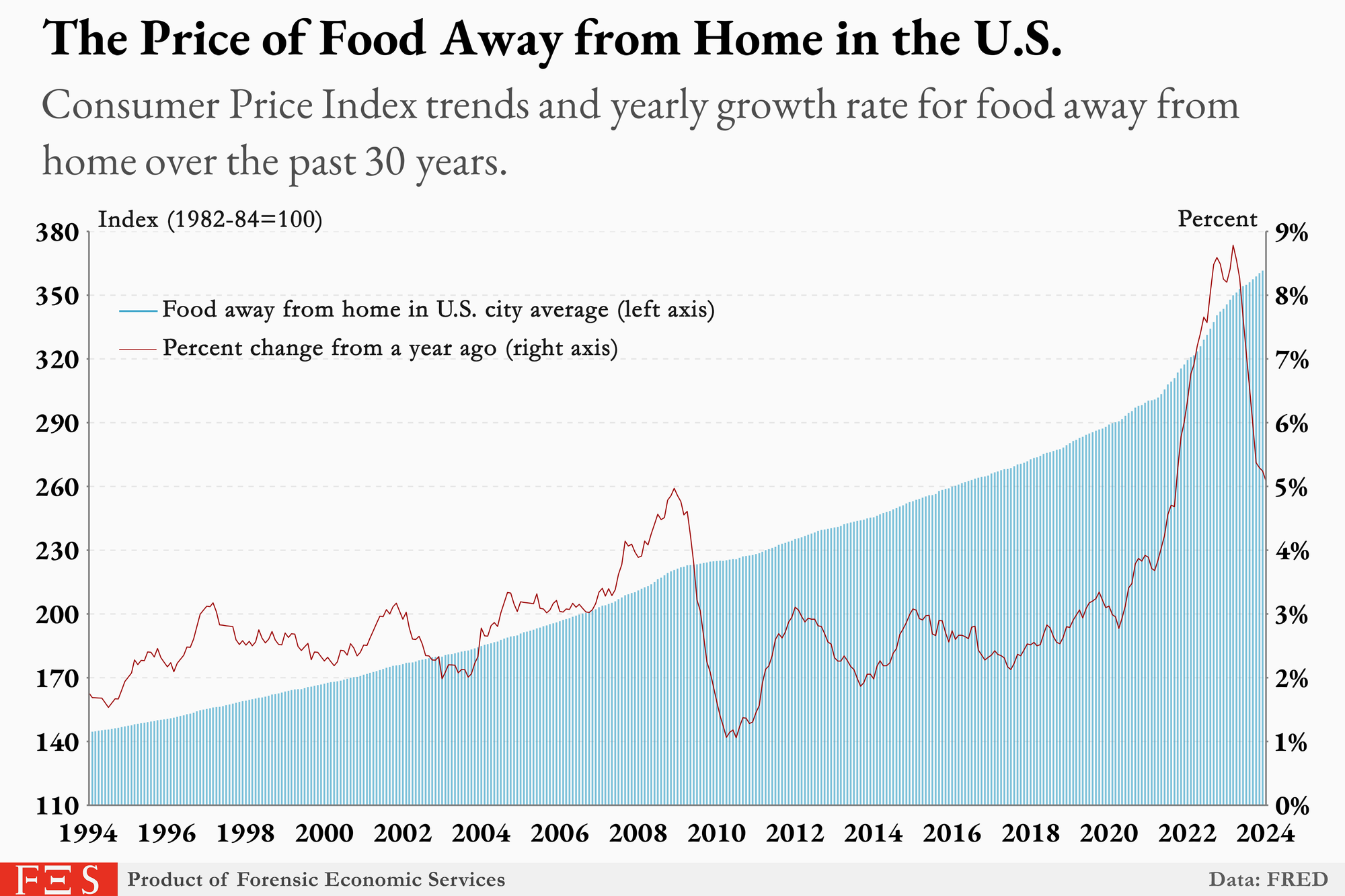

The United States is notorious for peddling highly accessible, dangerously palatable foods. This comes in the form of ultra-processed fast food options, door delivery services, snacks loaded with carbs and fats, and supersized portions. In addition to contributing to health issues such as obesity, high blood pressure and rising diabetes rates, they also all directly and indirectly contribute to the amount of money we're spending on groceries and dining.

Many sources (1, 2, 3) have found that Americans are outsourcing their own cooking the majority of the time. Given the above statistics about the outsized costs of such dining, this exemplifies an alarming part of American culture. Cutting back in this regard, and cooking whole foods at home, gives you a lot more control over your food budget. This may seem like a minor point, but the average American is spending ~$350 per month on groceries and ~$330 per month dining out. Especially when factoring in holistic health, rethinking your diet and eating habits can result in some rather significant wins for the wallet.

Budgets simply aren't fashionable

The world of fashion is perhaps one of the more obvious contributors towards our pervasive and questionable spending habits. This brand of consumerism is unique in that the driving force is fairly transparent. The majority of public sentiment for fashion stems directly from companies launching propaganda campaigns. Of course, propaganda has a negative connotation and so they call this "marketing." Regardless what they call it, apparel and accessory companies in the United States spent an eye-watering $29.5 billion on advertising in 2025.

Apparel and accessories are a solved problem, though. In post-industrial America, we have access to manufacturing materials and fabrications that make clothing more obtainable than any other time in human history. As an extreme case study, we can consider the humble diamond. Lab-grown diamonds are chemically, physically and optically indistinguishable from their naturally occurring relatives. The offer all of the same qualities, but at 80-90% lower costs. And yet, has the United States diamond industry faltered? No, in fact the opposite is true! The United States mined diamond industry was valued at ~$60B in 2024, and expected to grow rapidly over the coming years.

While diamonds may be a shining example, they are only indicative of the broader cultural influences afflicting the average consumer. We can see the same manifestations appear in dresses, shirts, pants, boots, hats, and more. People continually pay exorbitant premiums for apparel that is viewed as superior, when many alternative products exist that are comparable, if not indistinguishable.

Conclusion

To be clear, I don't mean this to be dismissive of the broader socioeconomic issues that are plaguing our country. Nor do I mean this to be a cry for Americans to pull themselves up by their bootstraps. In many ways, we are the victims of our environment. Both objective problems like wealth distribution and affordable housing, but also societal problems influenced through our culture and media. I hope that this article provided some food for thought on how we might re-examine our cultural wiring to start making smarter financial choices.